Interim billing

- First instalment is due February 28

- Second instalment is due March 31

Final billing

- First instalment is due August 31

- Second instalment is due September 30

This website uses cookies to enhance usability and provide you with a more personal experience. By using this website, you agree to our use of cookies as explained in our Privacy Policy.

Please click on the links for downloadable PDFs:

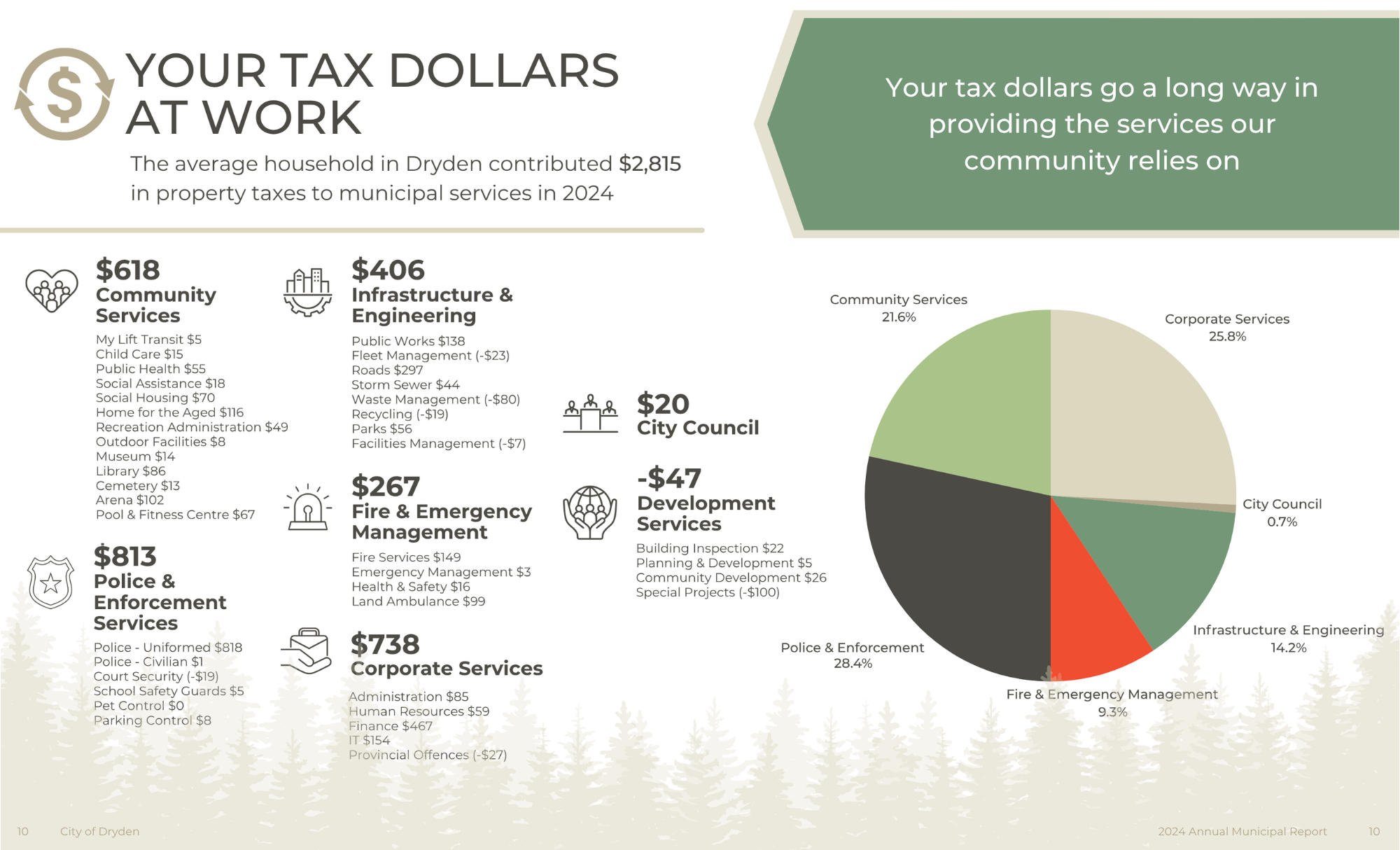

To see how your tax dollars are spent:

You can pay by:

The Municipal Property Assessments Corporation (MPAC) completes a re-assessment of property every four years and sends a Notice of Assessment to every property owner. If you have any questions about your assessments, you can contact MPAC by phone at 1-866-297-6703 or by email.

You can have property assessment value reviewed by applying for a Request for Reconsideration through MPAC.

You can apply for a tax rebate for your eligible charity if you have a registration number issued by Revenue Canada.

Tax certificates requested for properties can be provided by the tax clerk for a fee.

You can contact the Tax Clerk via email at taxes@dryden.ca

Contact Us

Finance Department

30 Van Horne Avenue

Dryden, Ontario

P8N 2A7

Phone: (807) 223-1113

Email: financedept@dryden.ca